Tax-Free in Phuket: VAT Refunds 2024 – A Guide for Travelers

Phuket, a tropical paradise, is not just about sun-kissed beaches and azure waters; it’s also a haven for shoppers. In 2024, understanding the VAT (Value-Added Tax) refund process in Thailand is crucial for tourists looking to maximize their shopping experience. Let’s dive into the essentials of claiming your VAT refunds, ensuring your shopping spree in Phuket is as rewarding as it is enjoyable.

Understanding VAT Refunds in Thailand

Who Can Claim a VAT Refund in Phuket?

Phuket, Thailand’s jewel, is not only a destination for its stunning beaches and rich culture but also a shopper’s paradise. Understanding who can claim a VAT refund and how it works is essential for tourists. Here’s a detailed breakdown:

Eligibility for VAT Refund

- Non-Thai Nationals: The VAT refund in Phuket is exclusive to tourists, which means you must not hold Thai nationality.

- No Domicile in Thailand: Eligibility extends to those who do not have a domicile in Thailand, making this a perk specifically for international visitors.

- Non-Airline Crew Members: If you are an airline crew member departing Thailand on duty, you are not eligible for the VAT refund.

- Departure Through an International Airport: The refund is only applicable if you depart Thailand from an international airport.

- Purchases from Designated Stores: Look for stores with a “VAT REFUND FOR TOURISTS” sign – these are the establishments where you can make eligible purchases.

- Documentation Requirements: Present the goods, along with the VAT Refund Application for Tourist Form (P.P.10) and original tax invoices, to the Customs officer before your airline check-in on the departure date.

VAT Refund Conditions for Tourists

- Store Eligibility: Goods must be bought from stores displaying the “VAT REFUND FOR TOURISTS” sign.

- 60-Day Rule: Goods must leave Thailand with the traveler within 60 days from the purchase date.

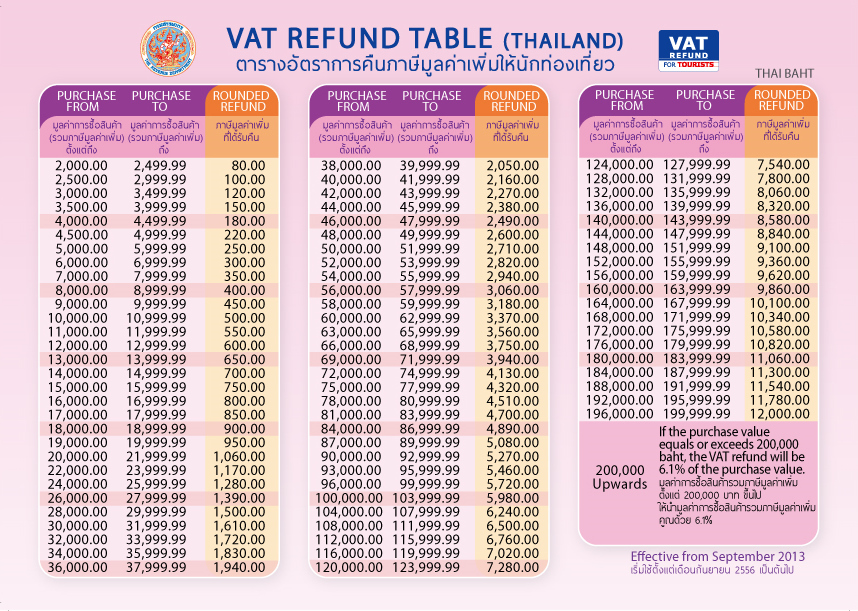

- Minimum Spend: Purchases should be at least 2,000 Baht (VAT included) per day, per store.

- Documentation at Purchase: On the purchase date, present your passport and request the store to issue the VAT Refund Application for Tourists form (P.P.10) along with the original tax invoices.

- Customs Inspection: These documents and goods must be presented to a Customs officer for inspection before check-in at the airport.

- Luxury Goods: For items like jewelry, gold, watches, etc., valued over 10,000 Baht, you need to hand carry and show them again at the VAT Refund for Tourists Office after passing through immigration.

Claiming Your VAT Refund in Thailand

At the time of purchase, show your passport and ask for the VAT Refund Application for Tourists form (P.P.10) and original tax invoices. Before checking in at the airport, present these documents along with the goods to a Customs officer for inspection.

Claiming the Refund

Tourists can claim a VAT refund at the designated counter at an international airport. Alternatively, they can drop the documents in a box in front of the VAT Refund office or mail them to the Revenue Department of Thailand.

Claiming the VAT Refund At the Airport

Ensure that the total value of the purchased goods is 5,000 Baht or more. For luxury goods valued at 10,000 Baht per item and carry-on items valued at 50,000 Baht per item, these must be presented again at the VAT Refund Office post-immigration.

Read More: Currency Exchange at Phuket Airport: Changing Money 2024

VAT Refund Payment Methods

- For Refunds Not Exceeding 30,000 Baht: Choose between cash (Thai Baht), bank draft in four currencies (US$, EURO, STERLING, YEN), or a transfer into a credit card account (VISA, MASTERCARD, JCB).

- For Refunds Exceeding 30,000 Baht: The refund is made either in the form of a bank draft or transferred into a credit card account.

Don’t Miss The Best Tours in Phuket

New VAT Refund Rules in 2024

Tourists who spend less than 20,000 baht on purchases now have the convenience of directly requesting a VAT refund from the Revenue Department, bypassing the need for customs procedures.

The Revenue Department of Thailand has updated VAT refund rules for a smoother process:

- The purchase threshold for customs declaration has increased from 5,000 to 20,000 Baht.

- Expanded categories for goods declaration now include items like smartphones, laptops, and luxury accessories.

- Purchased goods must be taken out of Thailand within 60 days.

- For luxury items valued over 40,000 Baht, and items over 100,000 Baht, additional certification is required at the tax refund office post-immigration.

Why VAT Refunds Might be Disapproved

Be aware of reasons for disapproval:

- Diplomatic passport holders or those residing in Thailand are ineligible.

- Goods not inspected by Customs or Revenue officers, or not taken out of Thailand within 60 days, lead to disqualification.

- The total value of purchases less than 2,000 Baht per day per store, or discrepancies in documents, can also cause disapproval.

Making the Most of Your Shopping in Phuket

Best Places to Shop

Phuket is dotted with shopping havens. For the best VAT refundable deals, visit:

- Jungceylon Shopping Mall: A one-stop destination for a diverse range of products.

- Central Festival Phuket: Offering a mix of local and international brands.

- Phuket Weekend Market: Perfect for unique finds and local handicrafts.

Ensure these stores display the ‘VAT Refund for Tourists’ sign.

Read also: 15 Shopping Malls in Phuket: Best Shops & Dining (2024)

Tips for a Hassle-Free VAT Refund Experience

- Keep all receipts and forms (P.P.10) organized.

- Plan your shopping to meet the minimum spend requirements.

- For luxury items, remember to hand-carry them for inspection post-immigration.

Conclusion: VAT Refunds in Phuket

Phuket’s shopping scene is vibrant and diverse, and knowing the ins and outs of the VAT refund process can make your experience even more fruitful. Keep this guide handy, and embark on a shopping journey that’s not just about the treasures you find, but also about the savings you can secure.

Don’t Miss The Best Tours in Phuket